If the US hits the debt ceiling, will there be a run on the banks?

If the US hits the debt ceiling, will there be a run on the banks?

And if there is, would the dept ceiling impose any limits on the FDIC’s ability to raise funds in the event of a bank failure?

The two questions seem the same to me: if there is confidence that the FDIC will have all the funds it needs, there will not be a run on the banks. But if there is any doubt, there will be, creating the very problem…

So, does anyone know if the FDIC would be limited or not?

What is the positive connection between the debt ceiling and runs on banks?

Here’s the scenario — and please note that I haven’t researched this, I’m just asking whether it is possible:

1. The US hits the debt ceiling.

2. [And here’s the issue I’m not sure about:] IF the the FDIC’s access to funds is limited by the US hitting the debt ceiling, then it would follow that the FDIC may not be able to pay off depositors at 100% (or, eventually, at all) if and when it takes over an insolvent bank because the FDIC won’t be able to lay hands on the needed money.

3. Depositors, learning about (2), will be much more likely to withdraw money from banks, especially those seen as at-risk.

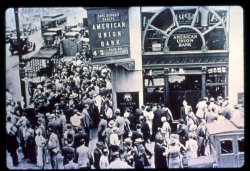

4. This very action will therefore push the at-risk banks into insolvency, creating a risk of a greater panic reaction, more withdrawals, etc, replaying the bank-run scenario of the Great Depression that the FDIC so effectively short-circuits.

Obviously, if the FDIC’s access to funds is not limited by hitting the debt ceiling, none of this is an issue. So, my question: is the FDIC’s access to funds limited by the debt ceiling or not?

I found the following 2008 discussion online, but I don’t know if it’s correct and/or up-to-date:

Based on the above, it would seem the FDIC would be able turn to more solvent banks for the money, in which case this isn’t a big worry. (I believe, however, that the FDIC has changed how it raised money since 2008, although I don’t know if it affects the above.)

Interesting… But I wonder if the fact that moany (most?) people don’t really deal with money (cash) for most things – using debit and credit cards, direct deposit, on-line bill paying, etc. changes how people think about money, which would be the motivating factor in bank runs. More succinctly, I wonder if it’s out of sight out of mind – people won’t panic because they know most transactions are paper anyway, so far as it affects them (as opposed to the 1930’s)?

I actually wrote an article about this not too long ago. They are already in debt to the US Treasury and will be nonfunctional until the debt ceiling is raised.

http://www.westernfreepress.com/metablog_single.php?p=1423

True Hannah, the FDIC’s fund balance is negative, but this is largely due to an accounting formality that they followed conservatively and appropriately: liabilities are greater than assets, hence the negative fund balance. However, a third of the FDIC’s total liabilities is in the form of unearned revenue: ie, they collected cash before it was technically due to them. With the passage of time, that liability will “automatically” disappear and be recorded as revenue. The FDIC has not taken a cent from Treasury that it did not pay in itself from the insurance premiums it charges banks, and there are not yet any signs that it will need to do so in the immediate future. I left a more detailed response at the link you provide above.

The folly of Republicans causing a default via the debt ceiling is that it will make U.S. Debt more expensive, which will need to be paid for…With higher taxes!

Only $1 of every $9 will be accessible if there is a bank run. My suggestion clear your bank out end of July. Take out everything you have in small denominations of $20s, $10s, $5s and one dollar bills. The smaller the bill the better. Money will be very hard to come by at this point if there is a major run on the banks.

For those of u thinking this is a democrat vs. Republican issue you are still asleep. Wake up and realize that both parties have and always will prop one another up. They work together and are both attempting to devalue our currency to swoop in and get everything cheap. Repeat of the great depression. Reseach what politicians and banks did during the era and u will see warning signs of today.

All trust has been lost in government and financial institutions. This incident will be the catalyst to the final stand Americans make against the corrupt government and financial system that has hijacked America starting with the Federal Reserve inactment of 1913.

The folly of Democrats causing a default via the debt ceiling is that it will make U.S. Debt more expensive, which will need to be paid for…With higher taxes!

I don’t think anyone living in a reality-based universe could plausibly blame Democrats for this crisis.

All very good information on this site. Here we are at the11th hour and still no agreement. I appreciate the advise about taking money out of the bank in small denominations. I am sure this will all work out in a few months or so but it wil be easier knowing I have my money hidden away. I view the FDIC issue as something the news networks should be telling us. Go figure???

Let a finance major handle this.

The reason news networks aren’t giving any attention to the FDIC is that it really is a non-issue. The low-interest bearing deposit accounts where you most likely have your money are extremely safe right now. What are really getting hammered are money-market mutual funds. Not money-market deposit accounts, mind you, since those are FDIC insured, but rather money-market mutual funds. Mutual funds take depositors’ money and invest the money in Treasuries and other securities, yielding a higher return than normal deposit accounts. An account in such a fund is very similar to a checking account: customers can write checks against their investments, dollar for dollar.

In the past week though, billions of dollars have been pulled from mutual funds. Check out this Wall Street Journal article, and pay special attention to paragraph 7: http://online.wsj.com/article/SB10001424053111903635604576474580203604662.html . The money has been pouring into normal deposit accounts, the rationale being that they’re FDIC insured. The market still perceives normal deposit accounts as safe. What’s happening at any given bank is anyone’s guess, but in general, cash is pouring into banks that offer normal deposit accounts, shoring up those banks’ balance sheets. Interbank lending is slowing down, so that part is admittedly bad news, but banks will continue to be able to meet the normal withdrawal needs of their customers.

Even if a default, and the market volatility that follows, is the last straw that breaks the backs of a few problem banks, the FDIC should be fine. The FDIC already knows which banks are at risk; bank failures typically don’t happen overnight, even in the wake of the subprime mortgage crisis, so the FDIC probably already has resolution plans in place for any banks that would fail as a result of default.

Straight deposit payoffs, where the FDIC pays depositors, are rare. Typically what happens is the FDIC finds a healthy bank to purchase a majority of the failed bank’s assets and assume the deposits of the failed bank. The FDIC then pays the healthy bank cash for the difference between the deposits assumed and assets purchased (an equity adjustment). This allows the FDIC to resolve failures with a relatively small cash outlay. In 2010, 157 banks failed, more than in any year since the savings and loan crisis of the late 80s and early 90s. The FDIC funded $82 billion in deposits with a net cash outflow of only $15 billion. In the event that a default causes a true crisis, these purchase and assumption transactions are likely to continue: healthy banks would want access to cash. When assets are transferred from a failed bank to a healthy bank, these assets include the failed bank’s cash (the FDIC closes the bank before the cash reserves start facing true drains); the healthy bank also receives additional cash from the FDIC. Closings typically take place on a Friday afternoon and last through the weekend, with the failed bank opening as a branch of the healthy bank Monday morning. The FDIC even makes arrangements for ATM cards from the failed bank to work during the closure, and checks will still clear.

Large banks that fail do present a risk to the FDIC, but often times these failures are completely handled in the private sector: Wells Fargo bought Wachovia before the FDIC even had to seize the bank (Wachovia wasn’t even technically considered a failure), and JP Morgan Chase purchased WaMu (which technically was a failure) with absolutely no aid from the FDIC.

Even if the FDIC were to run out of cash, that would most likely take place in mid-2012, and by that point markets (even if there were turmoil) would have largely settled and the debt ceiling would have been raised, so the FDIC would have absolutely no difficulty in exercising its authority to borrow from the private sector or from Treasury.

Now, if you’re utterly convinced that August 2 is doomsday, withdrawing your money from your bank isn’t going to do you much good, since the dollar would (consistent with your line of thinking) be hit so hard that your cash wouldn’t have much buying power. You’d be better off buying about 2 weeks worth of groceries and essentials (in case things do get dicey and prices rise) on credit pre-default, and then paying off your credit bill post-default. Your money post-default would be worth less, but nominally it would be worth the same, so you could satisfy your debt with money actually worth less. You’d essentially be shorting the dollar. Even if there is turmoil post-default, it really most likely will only last a week or two, so as long as you can hold out for that time period, you might as well leave your money in your bank and earn the additional interest on your deposits that banks will be offering.